Here's What to Expect From Evergy’s Next Earnings Report

Headquartered in Kansas City, Missouri, Evergy, Inc. (EVRG) stands as a major electric utility holding company. Currently valued at $15.2 billion by market cap, it was created in 2018 through the merger of Kansas City Power & Light (KCP&L) and Westar Energy. The utility company is expected to announce its fiscal first-quarter earnings for 2025 before the market opens on Thursday, May 8.

Ahead of the event, analysts expect EVRG to report a profit of $0.64 per share on a diluted basis, up 18.5% from $0.54 per share in the year-ago quarter. However, the company missed the consensus estimates in three of the last four quarters while beating the forecast on another occasion.

For FY2025, analysts expect EVRG to report EPS of $4.03, up 5.8% from $3.81 in fiscal 2024.

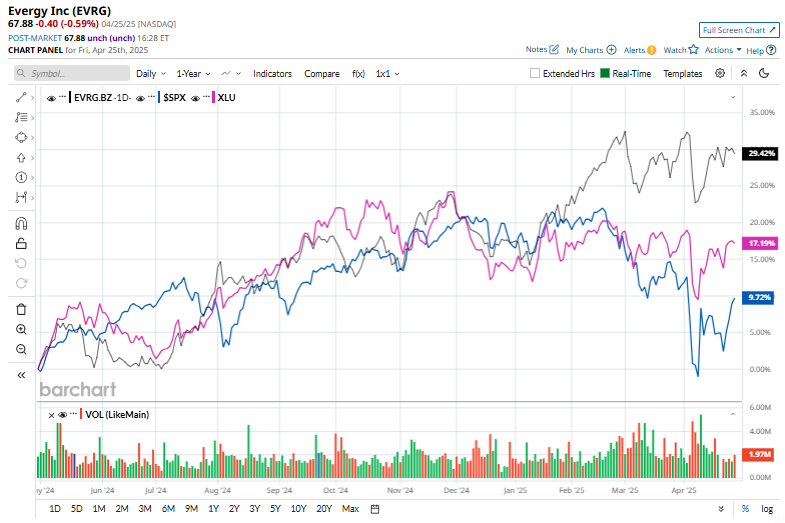

EVRG shares have returned 29.5% over the past year, outpacing the S&P 500 Index’s ($SPX) 9.4% gains and the Utilities Select Sector SPDR Fund’s (XLU) 16.9% gains over the same time frame.

Over the past year, EVRG has outperformed the broader market, driven by strong earnings growth, favorable regulatory outcomes, and strategic infrastructure investments. Additionally, Evergy benefited from a favorable settlement in its Missouri West rate case and announced plans to build two large natural gas plants in Kansas, which will help meet growing energy demand.

Shares of Evergy fell marginally on Feb. 27 after it released its Q4 earnings. The company reported an adjusted EPS of $0.35 for Q4 2024, falling short of consensus estimates. Despite a 29.6% year-over-year increase in EPS, factors like mild weather, higher depreciation, and rising operating and interest expenses tempered the benefits from new retail rates and growth in weather-normalized demand. Furthermore, the reaffirmed 2025 EPS guidance of $3.92 to $4.12, which slightly undercuts market expectations, contributed to a modest drop in shares.

Analysts’ consensus opinion on EVRG stock is cautiously bullish, with a “Moderate Buy” rating overall. Out of 12 analysts covering the stock, eight advise a “Strong Buy” rating, and four give a “Hold.”

EVRG’s average analyst price target is $71.67, indicating a potential upside of 5.6% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.